fjrigjwwe9r3SDArtiMast:ArtiCont

abortion clinics near me

abortion facts and statistics

open e="times new roman, times, serif">

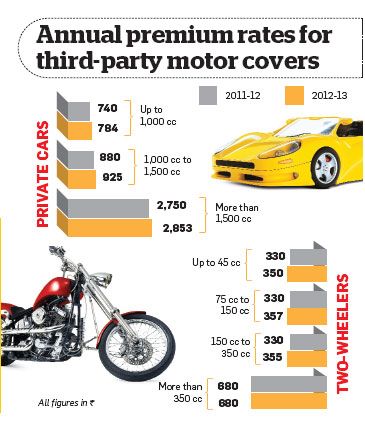

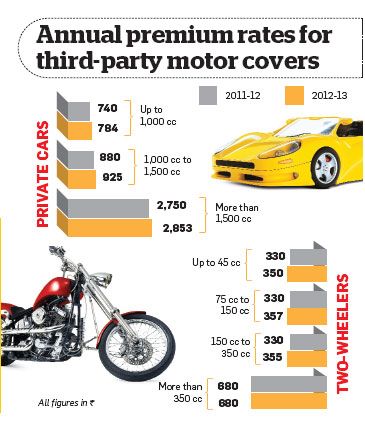

The insurance regulator has hiked the third-party motor insurance premiums in line with its decision last year to review the rates annually. Some insurers are also planning to revise their ’own damage’ rates. Put these two pieces of news together and it is a fair guess that your overall premium will go up when you buy or renew your motor insurance. Don’t lose hope though. There are many ways to keep the total premium on the comprehensive motor policy under control.

Let go of smaller claims

You are entitled to a no-claim bonus (NCB) for every claim-free year. If you don’t make any claim for a few years, the NCB can reduce your premium cost by as much as 50%. So, don’t rush to make a claim for fixing every small dent on your car. Sometimes, what you spend on repairs could be less than the amount you stand to lose as no-claim bonus. Weigh whether the damage is worth filing a claim for or is it smarter to wait for another claim-free year.

Opt for a higher deductible

You can also opt for a higher deductible amount in the policy. This means that you will pay the initial Rs 5,000-10,000 of the repair bill and the insurance company will pay the balance. The higher the deductible, the lower is the premium. However, don’t opt for too high a deductible just to bring down the cost of insurance. You might end up paying more than the amount you stand to save.

Share more information

Many insurers offer better rates these days to customers who are willing to share personal information, such as age, gender, marital status, occupation, claim history and driving track record. For instance, Berkshire Insurance, which distributes Bajaj Allianz’s motor insurance policies, offers a discount of 5% to those who provide details about themselves by answering the questions in the forms. "The premium for a young male who smokes will be higher than that for the same amount of cover for a young, non-smoking female," says Arun Balakrishnan, CEO, Berkshireinsurance.com. "The details help in the correct calculation of premiums and also in getting discounts of 10-25%," adds Niraj Jain, CEO, Insurancemall.in.

|

|

Be careful about add-on covers

The add-on features like depreciation cover, roadside assistance, emergency expenses, and hospital cash, may have immense utility value, but some agents try to push unnecessary covers as well. Tally the policy features with your needs before buying the add-ons. This will ensure that your premium is not inflated for options you may never use.

|

Sign up with auto associations

Becoming a member of the Automobile Association of India (AAI) or its affiliates gives you a discount on the premium rates from some insurers; the discount could be lower of 5% or Rs 200 on the own damage premium for private cars. Similarly, if you install an anti-theft device approved by the Automotive Research Association of India, you could claim a discount of 2.5%, subject to a maximum of Rs 500.

Stick to the mandated part of cover

As per the prevailing law, you have to buy a minimum cover of Rs 6,000 to compensate third parties for any property damage. Sure, you have the option to buy a higher cover, which may come in handy if there is a huge payout, but remember that your premium will also rise. If you want to keep the premium low, opt only for the mandatory cover. |